Broadway Bank

Since its beginnings in 1941 as San Antonio’s first suburban bank, Broadway National Bank has always been a trendsetter, introducing innovative financial policies which help shape modern banking.

Today, Broadway is the largest independently owned bank headquartered in San Antonio. But it began in a small storefront in Alamo Heights, founded by a military officer, Col. Charles E. Cheever Sr., and his wife, Elizabeth Cheever. They envisioned a financial institution that would serve the hundreds of military families who were migrating to San Antonio because of the war effort and the businesses which would serve those new residents.

The founders’ son and Chairman Emeritus of Broadway Bancshares Inc., Charles E. Cheever Jr., remember the bank’s modest beginnings as “a very difficult period.” After opening the bank, Col. Cheever was called to duty in Europe, where he spent the war years working as a Judge Advocate for Gen. George S. Patton. Mrs. Cheever, in her son’s words, was left “to hold things together” at home and at the bank, serving on the board of directors until her husband returned.

In succeeding decades, Broadway National Bank set numerous “firsts.” In 1959, it was the first San Antonio bank to establish a mortgage lending division and it was the first to extend its banking hours to help working families.

In 1983, the bank was the city’s first to offer on-site brokerage services. Broadway’s successful Wealth Management Division was established in 1984. In 1996, Broadway Bank acquired Financial Centers in Fredericksburg, Kerrville, Boerne, Castroville, Hondo, and Seguin, Texas.

In 2005, the bank acquired Balcones Bank with Financial Centers in San Marcos, Wimberley, Kyle and Buda starting its strategic move northward. The strategy continued to take shape with its addition of Bee Cave and Dripping Springs Financial Centers in 2010. Just a few years later in 2013, Broadway Bank announced its entry into the Austin region and today has two locations serving the downtown and mid-town area.

Just a year earlier, the bank launched its Broadway Bank Family Business Resource Center (bbfbrc.com ). The center, a vision of the Cheever Family is a place where family businesses can connect, share ideas, find solutions to common problems and access information on critical issues. The resource center is comprised of several dynamic components including a specially designed website, regularly scheduled informational events and family business networking opportunities.

Broadway Bank maintains its commitment to providing traditional and innovative products and services, while staying ahead by looking to the future, remembering the past, and concentrating on being here for the good of its customers.

Broadway Bank Service Telephone

Account Services:

(210) 283-6500

(800) 531-7650

Click here for more contact information.

Online Banking Login

How to Log In

1. Visit the bank’s website https://broadway.bank/.

https://ww.onlinebankinginfoguide.com

2. The Login is located to the right part of their page. You’ll be directed to another page and required to log in with your User ID and Password.

https://ww.onlinebankinginfoguide.com

How to Enroll

1. Click Register.

https://ww.onlinebankinginfoguide.com

2. Once you check the Agreement and click the I Agree button. You will be directed to another page and fill out all the blank fields with the needed information. Click on “Submit“.

https://ww.onlinebankinginfoguide.com

Video For Broadway Bank Free Checking

Routing/Wiring Instructions

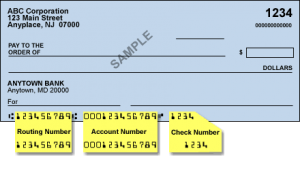

Broadway Bank customers will be required to have a routing number or routing transit number is a 9 digit number that identifies a financial institution in a transaction and the location where your bank account was opened. The most common types of transactions are ACH and wire transfers. You’ll often be asked for your checking account routing number when you’re making a payment online or by phone.

Some banks and financial institutions usually have multiple routing numbers serving different purposes, geographical regions, and branches. Therefore it is important to ensure that you are using the correct routing number before you initiate a money transfer.

A routing number can also be referred to as an RTN, a routing transit number, or an ABA routing number and can be easily be found printed on the bottom of a check or in the online banking portals of the financial institutions.

How to Find Your Routing Numbers on Check

The best way to find the routing number for your Marquette Bank checking, savings, or business account is to look into the lower-left corner of the bank check.

| Routing Number | Swift Number | |

|---|---|---|

| https://broadway.bank/ | 114021933 | Not part of SWIFT network |

Branch Locations And Opening Hours

Please click here for more location.

Website

Routing number

114021933