Access Bank

Access Bank Plc. is a leading full-service commercial Bank operating through a network of more than 600 branches and service outlets, spanning three continents, 12 countries, and 31 million customers. The Bank employs 28,000 people in its operations in Nigeria and has subsidiaries in Sub-Saharan Africa and the United Kingdom (with a branch in Dubai, UAE) and representative offices in China, Lebanon and India.

Listed on the Nigerian Stock Exchange since 1998, Access Bank is a diversified financial institution that combines a strong retail customer franchise and digital platform with deep corporate banking expertise and proven risk management and capital management capabilities. The Bank serves its various markets through four business segments: Retail, Business, Commercial and Corporate. The Bank has over 900,000 shareholders (including several Nigerian and International Institutional Investors) and has enjoyed what is arguably Africa’s most successful banking growth trajectory in the last twelve years. Following its merger with Diamond Bank in March 2019, Access Bank became one of Africa’s largest retail banks by the retail customer base.

As part of its continued growth strategy, Access Bank is focused on mainstreaming sustainable business practices into its operations. The Bank strives to deliver sustainable economic growth that is profitable, environmentally responsible, and socially relevant, helping customers to access more and achieve their dreams.

In honor of its defining roles across the African continent, Access Bank has been accorded recognition by reputable domestic and global organizations. Some of these recognitions include the 2019 World Finance Award “Best Digital Bank in Nigeria”; 2019 World Finance Award “Best Mobile App in Nigeria”; 2019 Karlsruhe Sustainable Finance Awards; “Outstanding Business Sustainability Achievement”; 2018 Euromoney Private Banking Awards “Best Commercial Banking Capabilities”; 2018 Euromoney ‘Africa’s Best Bank for CSR’ Award; 2018 CBN ‘Sustainable Bank of the Year’; ‘Sustainable Transaction of the Year (Oil & Gas)’, ‘Sustainable Transaction of the Year (Power)’; 2018 Global Banking and Finance Review, “Best Investor Relations Bank in Nigeria”; 2018 SERAS ‘Most Sustainable Company in Africa”, 2019 CEO Awards Forum “Gender Leader of the Year” just to mention a few.

Access Bank Customer Service Telephone

+234 1-2712005-7

+234 1-2802500

07003000000

01-2273007

Online Banking Login

How to Log In

1. Visit the bank’s website https://www.accessbankplc.com/.

https://ww.onlinebankinginfoguide.com

2. Click the Individual button located on the right part of their page.

https://ww.onlinebankinginfoguide.com

2. You will be directed to another page and required to log in with your Username.

https://ww.onlinebankinginfoguide.com

How to Enroll

1. Click on the “Individual” button.

https://ww.onlinebankinginfoguide.com

2. Once you click on the button, you will be directed to another page and click the Sign-Up button.

https://ww.onlinebankinginfoguide.com

2. After clicking the Sign-up. You will be directed to another page where you must enter your account number to procced the Access Online Registration.

https://ww.onlinebankinginfoguide.com

Video For How to activate your Access More Mobile App

Routing/Wiring Instructions

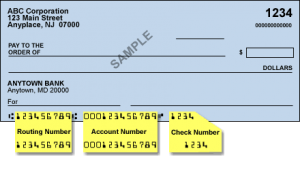

Access Bank customers will be required to have a routing number or routing transit number is a 9 digit number that identifies a financial institution in a transaction and the location where your bank account was opened. The most common types of transactions are ACH and wire transfers. You’ll often be asked for your checking account routing number when you’re making a payment online or by phone.

Some banks and financial institutions usually have multiple routing numbers serving different purposes, geographical regions, and branches. Therefore it is important to ensure that you are using the correct routing number before you initiate a money transfer.

A routing number can also be referred to as an RTN, a routing transit number, or an ABA routing number and can be easily be found printed on the bottom of a check or in the online banking portals of the financial institutions.

How to Find Your Routing Numbers on Check

The best way to find the routing number for your Marquette Bank checking, savings, or business account is to look into the lower-left corner of the bank check.

| Routing Number | Swift Number | |

|---|---|---|

| https://www.accessbankplc.com/ | 104014138 | Not part of SWIFT network |

Branch Locations And Opening Hours

Access Bank Head Office

| Lobby Hours | Contact Details |

|

8 AM – 6 PM

|

Tel: 01-280-2500

|

Ligali Ayorinde

| Lobby Hours | Contact Details |

|

8 AM – 6 PM

|

Tel: 08126416654 |

Muri Okunola Branch

| Lobby Hours | Contact Details |

|

8 AM – 6 PM

|

Tel: 08126416712 |

Please click here for more location.

Website

https://www.accessbankplc.com/

Routing number

104014138